The Craft Beverage Modernization Act of 2017: How to Make It Work for Your Brewery

Mar. 15, 2018A guest post from Gary Nicholas of Nicholas Brewing Projects

The Tax Cuts & Jobs Act of 2017 affects federal excise taxes (FET) and includes other provisions involving alcoholic beverages. According to the Craft Beverage Modernization & Tax Reform Act (CBMTRA) — a bill introduced into both the U.S. House of Representatives and the U.S. Senate during the 115th Congress — this new section in the Tax Cuts & Jobs Act will reduce FET on alcoholic beverages, including those made by smaller breweries. These tax savings have led to numerous discussions regarding how this will lead to increased investment and hiring within the craft brewing community. While this will be true for some, many breweries would benefit from looking at a broader range of options.

Federal Excise Tax Deductions 101

Prior to January 1, 2018, large breweries paid federal excise taxes at a rate of $18 for every barrel brewed. Breweries that fell into the “Small Domestic Brewer” category, meaning those that produced less than two million barrels per calendar year, were taxed at a reduced rate of $7 per barrel on the first 60,000 barrels. As part of the tax reform, the federal excise tax rates became:

- $16 per barrel on the first six million barrels of beer brewed in a calendar year, after which the rate increases to $18 for all barrels in excess of six million;

- Small Domestic Brewers continued to be defined as “brewers in the United States who produce no more than two million barrels of beer during the calendar year.” Excise tax rates on the first 60,000 barrels dropped 50% to $3.50 per barrel. Taxes on production in excess of 60,000 barrels will be assessed at $16 per barrel.

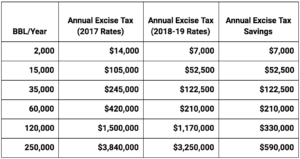

The vast majority of breweries in the United States fall into this “Small Domestic Brewer” category, and most produce less than 60,000 barrels per year. In fact, according to the most recent brewery statistics available from the Brewers Association, there are fewer than 200 craft breweries that produce more than 15,000 barrels per year, out of over 5,200 total breweries in the craft sector. The table below shows the effect of the FET reduction on a range of brewery sizes.

Recommendations

Much of the fanfare and media reporting about expected economic benefits from these tax savings has revolved around hiring increases and capital investment on new tanks and other production equipment. This will be true for some breweries, but there are challenges. The original language of theCraft Beverage Modernization Act of 2017 intended for the excise tax reductions to be permanent, but the Tax Cuts & Jobs Act of 2017 includes a sunset clause: the lower rates are only effective from January 1, 2018 through December 31, 2019. Congress may extend the FET reduction or even make them permanent, but there is no guarantee, especially during a midterm election cycle.

For the regional breweries producing over 15,000 barrels per year, the tax savings provide a substantial pot of money to fund capital investment and hiring. A quick look at the earlier table shows the relative increases, and the totals only increase from there: the handful of breweries making more than 500,000 barrels per year will receive a minimum in $1,000,000 per year in tax savings between now and the end of 2019.

These regional breweries make up less than 4% of the total breweries in the US, however. For the remaining 96%, the pot of money is significantly smaller. For many, these tax savings will roll into their general operating funds and help improve their working capital & cash flow. Others will choose to invest in new kegs, fermentation vessels, and related production equipment or hire on new staff. All of these are viable strategies, but there are other options to consider:

- Deferred maintenance & general infrastructure: Small breweries have a proud tradition of using refurbished and repurposed equipment, but everything breaks eventually. Often, we try to make do, but one of the truisms in brewing is that poorly maintained equipment performs poorly. Even brand-new equipment has to be maintained properly. Using tax savings to catch up on repairs will lead to a safer working environment, higher quality beer, and smoother production.

- Critical parts inventories: Developing a critical parts inventory involves looking at your process, identifying equipment that has a significant effect on quality or operational capacity, and then purchasing critical spare parts in advance that would otherwise have a lengthy lead time to source or be exorbitantly expensive to ship overnight. This can be costly up-front, but being able to limit your downtime is a significant advantage.

- Leverage points: This is a broad-ranging category, but the idea is to find ways to increase revenues by minimizing waste, loss, and inefficiency. The ROI on these may have a long horizon, leading managers to put them off, but a tax savings windfall can simplify the financial equation. Examples would include:

- QA/QC instrumentation;

- IT investment such as sales analytics packages, keg tracking systems, brewery/inventory management software, OEE/maintenance management systems, etc.;

- Efficiency/sustainability programs & equipment (recycled material balers, utility sub-meters, wastewater monitoring, occupancy sensors for light fixtures in low-traffic areas, etc.)

This is not a complete list by any means: breweries will have to conduct a needs assessment to determine what will provide the best value for their operations. Equally viable options would be to help defray the costs of health insurance & other benefits or to raise wages for existing staff, especially if the FET reductions are extended beyond 2019. The main goal here is to look for ways that will help strengthen your overall business.

If you have any questions about how the Craft Beverage Modernization Act of 2017 will affect your business or if you’d like to learn more about federal excise tax deductions, don’t hesitate to reach out to the expert craft beer, spirits, and wine attorneys at Hop Law.